Competitive Pricing | Definition, Tips, and Examples

Time and time again studies show that pricing is one of the most important decision-making factors for consumers.

This explains why online retailers do everything they can in order to set the most attractive prices, without sacrificing their margins.

In online retail, one pricing strategy seems to combine both efficiency and ease of implementation with the possibility of preserving desired profit margins. We are talking about competitive pricing.

Competitive pricing is a pricing strategy where a business sets the price of its products based on competitors’ prices.

Synonyms of competitive pricing are:

- competition-based pricing

- competitor-based pricing

- competition-oriented pricing

- market-based pricing

- market-driven pricing

At the core of competitive pricing is competitor analysis. Here, accuracy is key, especially when talking about tracking competitors’ prices.

Be careful, however. There are some risks when implementing this pricing strategy. We will get to those later on in the article. Make sure you read until the end.

Three Competitive Pricing Tactics

Competitive pricing is a pricing strategy. As with each strategy, there are multiple ways, or in other words tactics, how you can apply it. In the case of competitive pricing, there are three primary tactics:

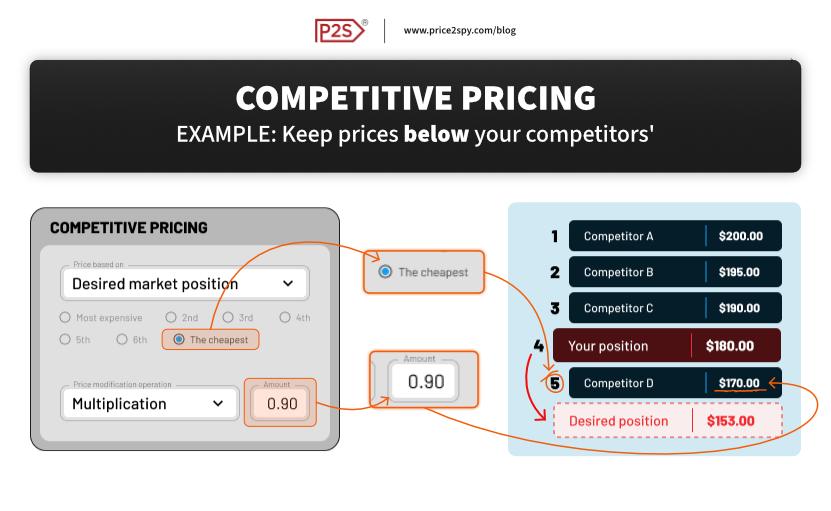

- Go below the competitor’s price.

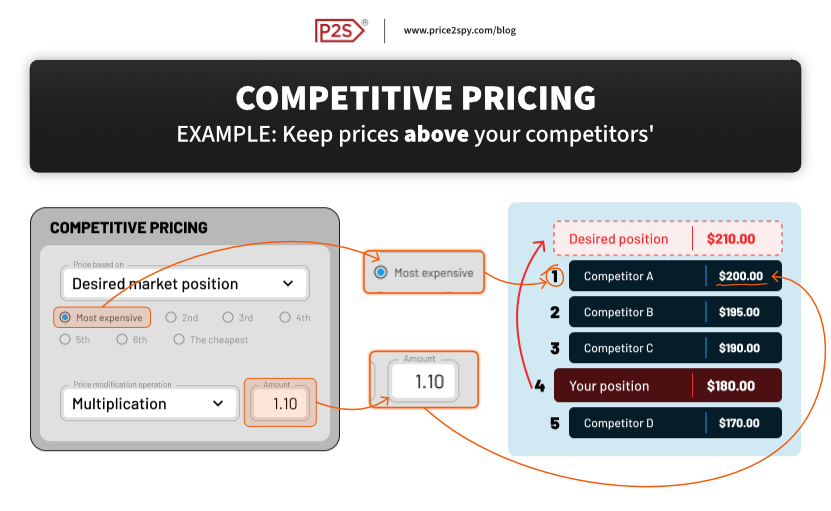

- Go above the competitor’s price.

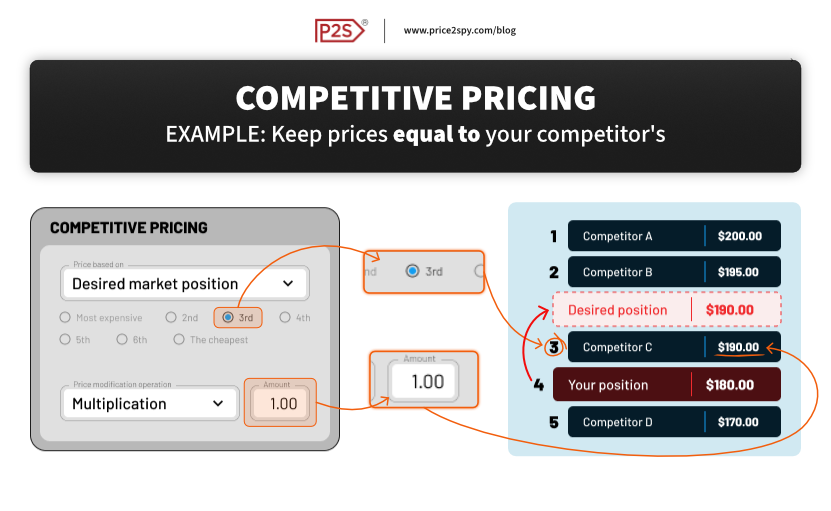

- Keep prices equal to your competitor’s.

Let’s take a closer look at each of them and see when one may be used instead of the others.

Keep prices below competitors’

The most notable case of undercutting your competition would be when you are entering a new market or trying to win a new customer segment.

Additionally, even though you’re selling at a lower price, higher sales volume can compensate for the lower margin per item. Retailers often rely on economies of scale. This means the more products they sell, the lower their per-unit cost, which helps offset the reduced profit margin.

But, besides that, when would you want to drop your prices and go below your competitors?

There are a couple of scenarios:

- Clearing out your inventory

- Promotional periods

- Exploiting price elasticity of particular products

- Resetting customers’ price expectations

This tactic is often used on a loss-leader product. It works by attracting customers toward a certain product with its lower price. The goal is to then entice customers to buy more by bundling the loss-leader product with other high-margin or complementary products. Alternatively, the goal can be more long-term, such as an increase in market share.

Keep prices above competitors’

Going above your competitors’ prices is frequently done when you have a high-demand item in stock, which your competitors don’t.

Just like lowering your prices, increasing them affects your brand image as well. By keeping your prices high you signal high-quality products, service, and support to your customers.

This tactic is also common in the consumer electronics industry (and tech in general). Tech products can easily be measured and compared in terms of performance, features, and the benefits they bring to the consumer.

On the other hand, luxury goods can’t be that easily measured in terms of quality. Yet, these items also have their prices increased frequently. Why is that? There are a couple of reasons:

- Veblen effect – This effect describes the situation in which a higher price makes the product more desirable. This is because the perceived value is such that more expensive items are seen as more luxurious, exclusive, and high-status.

- Perceived value – Perceived value influences the price customers are willing to pay—not just what a product costs. It’s shaped by factors such as brand reputation, packaging, marketing, and exclusivity.

- High customer loyalty – Some customers simply love purchasing from certain brands and those brands have recognized that. In some cases it’s because of the high product quality, in others because of impeccable customer service. Either way, in such cases (low) prices aren’t the main motivating factor for customers.

One last thing we want to mention related to this competitive pricing tactic is price skimming. Price skimming is the act of initially setting your prices above your competitors’ but gradually decreasing them over time, usually along with the levels of demand. The term ‘skimming’ comes from the fact that the sellers are skimming the revenue from different customer segments, one by one, with each subsequent price decrease.

Keeping prices equal to competitors’

When the competition tightens the margins, there’s little room for price adjustments. In such cases, equal prices are the go-to option for many retailers.

What this does is that it makes prices a non-factor in your customers’ purchase decision process. Instead, they will base their decision on your brand’s strength and trustworthiness, delivery cost and time, and potential additional fees.

When faced with a situation like this, despite the importance of pricing, perhaps don’t tunnel-vision on it. Consider other aspects of your online store. Think about the checkout process, the user experience and navigation, design and whether your website is on-brand, the width and breadth of your offer.

Examples of Competitive Pricing in the Real World

Let’s now take a look at what competitive pricing means for certain brands and industries.

A quick disclaimer before we get into it: these are only three select examples we thought are the most representative of competitive pricing. You may discover more ways to implement this strategy as you explore the market. Don’t let this confuse you. If you don’t immediately understand a particular competitive pricing strategy, go back to the three basics tactics and build your way up from there.

Amazon: Algorithm-driven competitive pricing

Amazon uses dynamic pricing as a core part of its competitive strategy. It monitors competitor prices in real time using automated tools and adjusts its own prices multiple times a day. This ensures that Amazon products remain among the lowest or most competitive in the market.

AI algorithms assess pricing data, competitor trends, and demand levels before updating listings. The platform also encourages third-party sellers to stay aligned with current market rates.

Tags like “Best Price” or “Lowest Price” reinforce price appeal. In addition, Amazon competes not only on product prices but also on shipping speed and delivery cost, matching or exceeding rival offerings.

Samsung: Direct price competition with Apple

Samsung applies competitive pricing when launching its flagship smartphones. It prices new Galaxy models either just below or at the same level as the latest iPhones.

Trade-in programs help lower the perceived cost, making it easier for customers to switch from Apple. Samsung also bundles accessories like earbuds or smartwatches to boost value.

In global markets, the company is faster than Apple in adjusting local prices to respond to demand or currency shifts. During Apple’s product launches, Samsung often counters with flash sales, creating direct competition and retaining customer attention through price-based promotions.

Industry example: Home appliances

The online market of home appliances is saturated with similar products. Since features are relatively similar or the same, the next most important factor for selling these items is the price. Online retailers of home appliances often deal with these situations by using a price monitoring and an automated repricing tool.

Firstly, with such a tool they monitor competitors’ prices and benchmark their own competitiveness. Next, they identify products where they are more or less expensive and make adjustments. However, due to the large number of products in this category, sellers use automated tools to do this instead of them.

As we have mentioned already, rough competition often means tight margins. This is why price changes are made with caution, in order not to eat into profits more than necessary. Also, when talking about sellers, they also have to care about not violating any MAP policies they have agreed to.

Let’s take a look at a specific example: an online retailer selling a popular brand of washing machines.

They notice that one of their main competitors has dropped the price by 5% on a specific model. Their price monitoring tool flags this change immediately. Using automated repricing, the system responds by reducing their own price just enough to stay competitive, while still maintaining a profitable margin.

However, before executing the change, the repricing algorithm checks against predefined limitations set by the retailer—such as minimum margin thresholds, pricing floors, or brand-specific rules. If the suggested new price would violate any of these constraints, the system either refrains from making the adjustment or recommends an alternative approach, like offering added value through services or bundles, to stay competitive within the established boundaries.

Benefits and advantages of competitive pricing

Increased conversion rates and sales

By aligning prices with or undercutting competitors, retailers become more attractive to price-sensitive customers. This directly improves click-through and conversion rates, especially on marketplaces and comparison-shopping platforms where consumers see multiple prices side-by-side.

Better market positioning

Competitive pricing helps a retailer stay relevant in a saturated market. It enables them to benchmark their offers against competitors, identify pricing gaps, and position themselves as either the best value option or a premium alternative, depending on their strategy.

Optimized profit margins

While competitive pricing focuses on being attractive to customers, it can also be balanced with margin rules and business goals. Smart repricing tools ensure that even aggressive pricing remains profitable by factoring in minimum margins, stock levels, and demand.

Increased market share

Competitive pricing helps attract more customers from competitors, especially in markets where price is a key decision factor. By consistently offering attractive prices, retailers can grow their customer base, outperform rivals, and capture a larger share of the market over time.

Data-driven pricing decisions

Competitive pricing is not just about lowering prices—it provides valuable insights. By monitoring competitor behavior and market trends, retailers gain a clearer picture of pricing patterns, seasonal demand, and customer preferences, helping them make informed strategic decisions beyond just pricing.

Risks with competitive pricing

Going in blind

Going into a competitive pricing strategy without sufficient data or market research can be a significant risk. If a retailer sets their prices without understanding competitor pricing, market demand, or customer price sensitivity, they might make pricing decisions that aren’t aligned with the market or the business’s objectives. For example, pricing too low might result in unforeseen losses or missed profit opportunities.

Damage to your margins

Competitive pricing often involves adjusting prices based on competitor actions. This can lead to reduced profit margins if prices are constantly driven down to remain competitive, especially in price-sensitive markets.

Race to the bottom

The “race to the bottom” is a common and dangerous result of competitive pricing. It happens when multiple competitors continually undercut each other’s prices, resulting in a downward spiral of price reductions that drives profit margins even lower. In some cases, this can cause businesses to sell products for less than the cost of production, which is unsustainable in the long run.

Not sustainable

Pricing competitively by continually lowering prices may not be sustainable in the long term. Initially, this tactic might drive high volumes and sales growth, but it could hurt profitability and may not work if it leads to an unhealthy focus on price alone.

Conclusions & key takeaways

Hopefully we’ve introduced you to the concept of competitive pricing enough so that you start considering implementing it in your own store.

We have also tried to clear up some misconceptions related to competitive pricing:

- Competitive pricing doesn’t only mean lowering your prices. It also means going above your competitors or following their tracks.

- How you apply competitive pricing will highly depend on the industry you’re in. Different rules apply for luxury goods, consumer electronics, and home goods.

- There are risks to it. Make sure you are gathering enough competitive data before you try to implement this pricing strategy.

If you want to implement an automated competitive pricing strategy in your own store, then make sure to register for a free Price2Spy trial. It offers an intuitive, yet powerful, Pricing Strategy builder that’s based on repricing rules you set.